Read Time: 4-minutes

Happy Saturday,

Here is this week’s edition of 6-Point Saturday — financial insights to help you make smarter money decisions.

Table of Contents*

*Clickable in the online version.

Point #1 — Short Story: The Miller, His Son, & the Donkey

“One day, a long time ago, an old Miller and his Son were on their way to market with a Donkey which they hoped to sell.

They drove him very slowly, for they thought they would have a better chance to sell him if they kept him in good condition. As they walked along the highway some travelers laughed loudly at them.

‘What foolishness,’ cried one, ‘to walk when they might as well ride. The most stupid of the three is not the one you would expect it to be.’

The Miller did not like to be laughed at, so he told his son to climb up and ride.

They had gone a little farther along the road, when three merchants passed by.

‘Oho, what have we here?’ they cried. ‘Respect old age, young man! Get down, and let the old man ride.’

Though the Miller was not tired, he made the boy get down and climbed up himself to ride, just to please the Merchants.

At the next turnstile they overtook some women carrying market baskets loaded with vegetables and other things to sell.

‘Look at the old fool,’ exclaimed one of them. ‘Perched on the Donkey, while that poor boy has to walk.’

The Miller felt a bit vexed, but to be agreeable he told the Boy to climb up behind him.

They had no sooner started out again than a loud shout went up from another company of people on the road.

‘What a crime,’ cried one, ‘to load up a poor dumb beast like that! They look more able to carry the poor creature, than he to carry them.’

‘They must be on their way to sell the poor thing's hide,’ said another.

The Miller and his Son quickly scrambled down, and a short time later, the market place was thrown into an uproar as the two came along carrying the Donkey slung from a pole. A great crowd of people ran out to get a closer look at the strange sight.

The Donkey did not dislike being carried, but so many people came up to point at him and laugh and shout, that he began to kick and bray, and then, just as they were crossing a bridge, the ropes that held him gave way, and down he tumbled into the river.

The poor Miller now set out sadly for home. By trying to please everybody, he had pleased nobody, and lost his Donkey besides.”

When you try to live by everyone else’s standards, you end up disappointing yourself.

You become pulled in different directions—depending on who you’re thinking about in the moment.

This leads to all kinds of pressure & poor behavior:

You stretch your spending to signal you've "made it"

Influencers on Instagram make you feel you’re not traveling enough

You feel pressure from an old friend insisting you’re missing out on crypto

Grandparents who grew up hearing Depression-era stories warn you to save every penny

Ultimately, you fail to honor your goals & values.

There's a better way.

It begins with getting clear on your values.

Because when you have your values set, determining your goals becomes much easier.

This clarity allows you to stop wasting your resources on everyone else’s expectations, and finally put your money where it matters most to you.

Point #2 — 3 Revealing Questions: A Core Values Mini-Exercise

So, here’s a quick exercise to help you define your core values.

First, let’s define what “values” mean.

Values are how we approach things in life. Whereas goals are what we choose to do.

For example, if you value security, you might prioritize aggressively paying off debt over upgrading your car.

If you value generosity, you may want to add or increase your giving to your budget.

Someone valuing family may choose to keep weekends work-free, even if it slightly decreases their income.

What are some of your values?

Adventure? Fairness? Stability? Generosity?

3 questions to ask yourself:

Think back on the past couple of weeks. Were there moments when everything felt aligned?

Look back at your past few credit card or bank statements. Were there purchases that felt disproportionately enjoyable?

Scroll through your last few months of pictures and look back on your calendar. Were there experiences that you especially enjoyed?

What underlying values were you honoring in these moments?

Start to put together a list of your values. One example that went viral on social media this week:

Eventually, it can help to narrow your values down to about 4 to 6 “Core Values” so you can streamline your decision-making even more.

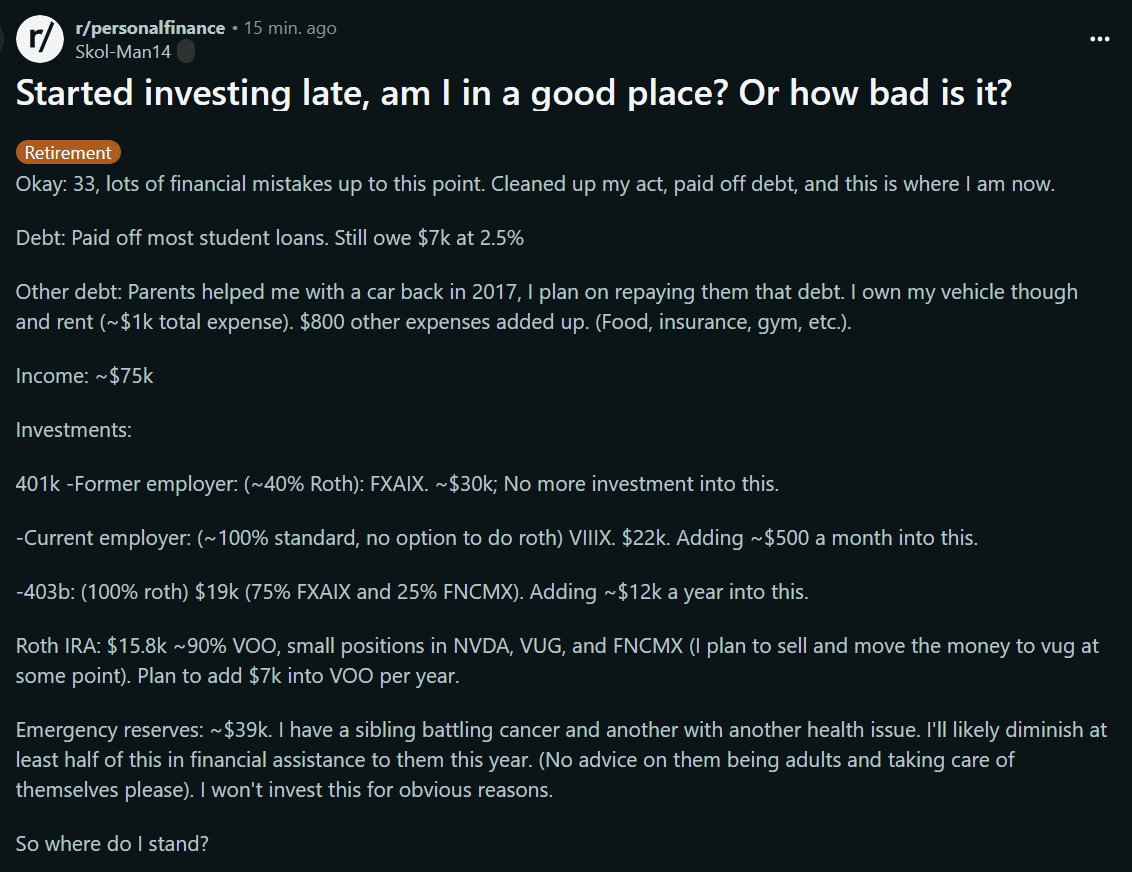

Point #3 — “Started Investing Late, Where Do I Stand?”

It sounds like this individual has taken control of their finances, paid off a lot of debt, and moved on from past mistakes. That’s great progress in and of itself.

They’ve also built up a cash cushion (~$39k) and are investing consistently. There’s a lot here to be proud of.

But the question is focused on investments and how they stand.

Let’s first look at the asset allocation, or general mix of stocks, bonds, & cash.

This retirement portfolio is invested heavily in stocks. In fact, it’s almost 100%.

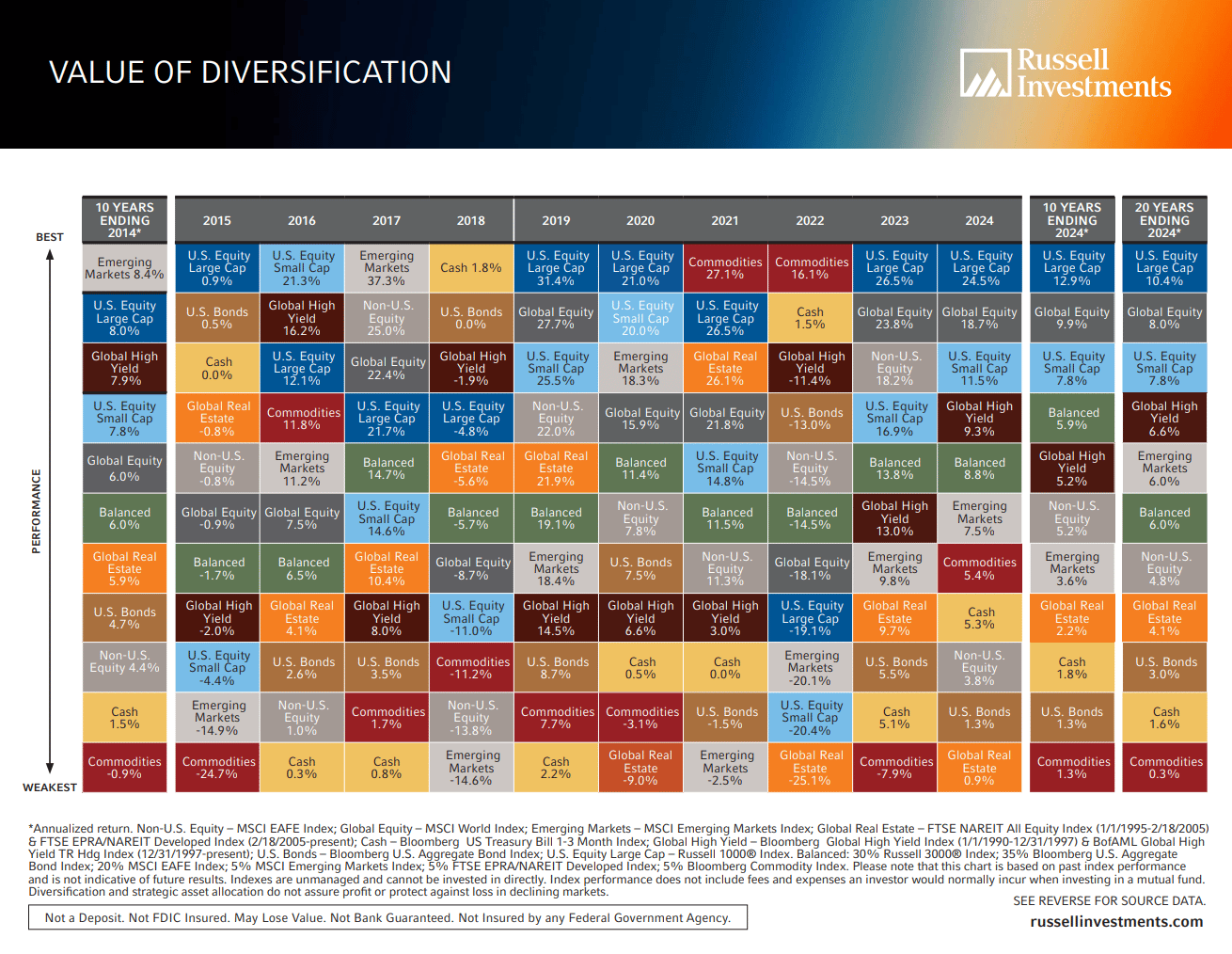

The Reddit user also comments in the thread that they don’t understand the purpose of international and small cap exposure.

As you can see, which asset classes perform best in any given year changes pretty frequently.

Which demonstrates the value of diversification, even if recent returns tend to suggest otherwise.

Now, onto the amount of retirement assets.

This person has about $86k across retirement accounts, and is adding roughly $25k per year. That’s an aggressive savings rate on $75k income, and very impressive.

Starting with $86k, adding $25k a year, and assuming a 4% inflation-adjusted return, by age 65 this person would have around $1.87 million, in today’s dollars (You can use free financial calculators like this one from Investors.gov to make these kinds of calculations).

Using the 4% rule, which says you might reasonably assume you can sustainably withdrawal 4% of your portfolio each year in retirement, that would give this individual roughly $74k per year (in today’s dollars) before taxes to withdrawal.

That’s in line with current income, which is a great place to be. Of course, income and spending will increase over time, which will likely increase retirement spending goals. But their aggressive savings habit is putting them in a solid position.

This individual already has clarity on one goal: helping family with health expenses. This suggests they value family & generosity.

Combined with clarity on their financial position, they can give generously, live out their values, and feel confident about their financial future.

👉 Get money-saving & wealth-building tips like these every Saturday morning. Join here.

Point #4 — Inflation-Adjusted Returns Explained

Why did we use an inflation-adjusted return in the analysis above?

Because inflation silently erodes the future purchasing power of your dollars.

You’ve probably noticed this in your day-to-day spending: $100 worth of groceries doesn’t go as far as it did just a few years ago.

This same dynamic gets amplified over decades.

That’s why if you use a long-term market return of 7–10% without adjusting for inflation, applying the 4% withdrawal rule will give you a number that looks better on paper than it would feel in reality.

The bottom line: Adjusting the return for inflation gives you a better sense of what retirement could be like, by putting your purchasing power in today’s dollars. A far more useful way to judge whether you’re really on track.

Point #5 — Quotes of the Week

Continuing the “clarifying your values” theme, which of these is your favorite?

“Life is complex and we are all faced with moments in our personal and professional lives that require us to make a choice without as much information as we need. The default assumption is that we need more knowledge or research in these situations, but often we just need a clear understanding of our values.”

“The question is not, how do I win the game? The question is, what games am I playing? Game selection matters more than winning the game because you can win the wrong game.”

Point #6 — My Questions of the Week

What's 1 past financial purchase that brought you joy, even if others may not have necessarily ‘approved’? What does this purchase reveal about your values?

How could you adjust your spending plan next month to make more purchases like this?

Reply to let me know! I read every response.

Thanks for reading — I hope you found a helpful idea or two.

I’ll see you next Saturday with more.

Have a great weekend,

Benjamin Daniel, CFP®

Founder, Money Wisdom

P.S. Want to take control of your money, stop stressing about your expenses, & feel confident about your financial future? There are 2 ways I can help you:

Financial Health Check: Get your biggest money questions answered, understand where you stand financially, and get a personalized action plan from a CFP® professional. Book a free Intro Call here to see if you’re a good fit.

Financial Coaching: If you’d like some accountability in getting your finances into shape, engage in financial coaching. Build the habits & systems to help you start building wealth, pay off debt, and feel confident about achieving your goals. Reply to this email and say “Coaching” to join the waitlist.

Disclaimer:

This material is not investment or tax advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher.

How helpful was today's newsletter?

👉 Is there another topic(s) you would like me to cover? If so, reply to this email & let me know—I read & respond to ALL emails.