Read Time: 4-minutes

Happy Saturday,

Here is this week’s edition of 6-Point Saturday — financial insights to help you make smarter money decisions.

Table of Contents*

*Clickable in the online version.

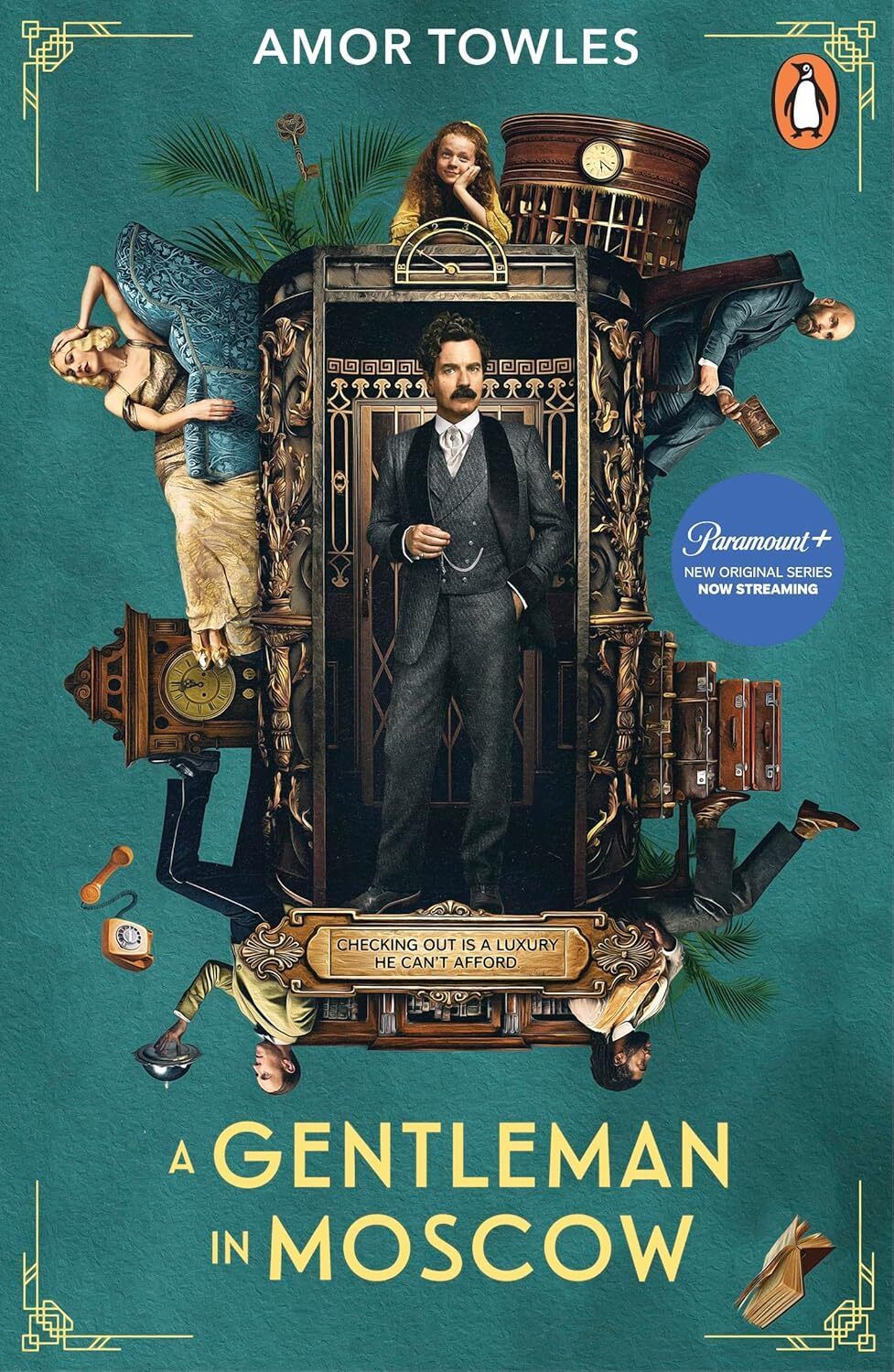

Point #1 — Your Money and “A Gentleman In Moscow”

“When he was in the investment business, Amor Towles would travel to the same city and stay in the same hotel during the same week, year after year.

During one of these annual visits, he walked into the hotel, and there in the lobby, Towles recognized a guy, a stranger, sitting exactly where he had been sitting when Towles was leaving the hotel the year before.

‘And I was like, ‘God, that guy must live here. What the hell?’’ Towles said.

‘Then in the elevator, I thought, ‘Oh, that’s actually kind of an interesting idea for a novel: A guy gets trapped in a hotel.’”

“When he got to his room, on hotel stationary, Towles sketched out ‘almost all of the key events of what became A Gentleman in Moscow.’

And then, ‘I spent the next couple of years building a detailed outline. Then in 2013, I retired from my day job and began writing the book.’

For two reasons, he didn’t tell anyone about what he was doing or working on. One, to protect his enthusiasm and belief in the project by not giving anyone the chance to tell him that he was insane or that it’s hard to write a book or that they actually tried to write a book once too. And, to avoid premature praise and validation.

‘This is a very interesting thing,’ Towles explains.

‘There’s a certain amount of energy that you need to sustain to write a book. You live with the material for a long period of time, during which you’re writing passages, revising passages, reading passages and rereading them and rereading them again. This takes a certain kind of stamina. And the worst thing you can do is start to talk about the thing before it’s finished. Because what you’re really doing is you’re trying to get people to tell you about how good the idea is or about how great you are. And what that does is it depletes the urgency to finish. You want the opposite: you want to be accumulating the feeling that you cannot wait to share the thing. Because when you’re going back into the draft for the 500th time, you need that feeling.’”

First, for any of you considering a “side hustle,” freelancing, or consulting in 2026, notice what Towles did.

He prepared on the side for years, creating the outline, before jumping in full-time.

Second, and as important, this story introduces an important topic with what could be perceived as contradicting advice:

When to share your goals with others, and when not.

You may have heard that sharing your goals can make you feel you’ve already started to achieve them, which actually can hamper making actual progress.

On the other hand, sharing your goals with others could mean your reputation is on the line, acting as another motivator.

And if you make big financial goals this year, from paying off debt, padding your emergency fund, or improving your savings & investing rate, this topic could be critical.

So, let’s look at exactly what the science says next.

Point #2 — The 2 Methods for Sharing Your Goals

The Case Against Sharing

Psychologist Peter Gollwitzer at NYU ran experiments [Gollwitzer, Peter et al, 2009] where individuals were observed executing a task after sharing their goals and after not.

Groups where others were not aware of the goals outperformed:

“When other people take notice of one’s identity-relevant behavioral intentions, one’s performance of the intended behaviors is compromised.”

Gollwitzer calls this "premature sense of completeness." You get the “dopamine hit” from the announcement itself, particularly around identity-based goals.

The Case For Sharing

In another study [Mathews, Gail, 2007] 149 people were randomly put in 5 groups tracking goal achievement. Goals included financially-related goals like increasing income, listing/selling a home, and increasing productivity.

Group 1: These individuals were simply asked to think about their goals, and rate them on factors like importance & difficulty.

Group 2: This group was also asked to write the goals down.

Group 3: These people were asked to also come up with action implementations.

Group 4: This group also sent all of the above to a friend.

Group 5: Finally, Group 5 also sent regular progress reports to their friend.

The individuals who sent progress reports (Group 5) significantly outperformed the other groups.

The Key Distinction

These studies don't necessarily contradict. They reveal two different types of sharing:

Gollwitzer's potential trap: Announcing "I'm becoming debt-free!" (identity goal, seeking validation, no structure)

Mathews' method: "I'm paying an extra $500 toward debt monthly…do you mind if I text you my balance on the 1st?" (specific action, structured check-ins, progress reporting)

One can hurt your motivation. The other can create accountability.

The key is to “know yourself” and keep an experimental mindset.

Pair your goal-sharing with an accountability system, particularly if you’re setting an identity-based goal. Or, if like Towles, there are factors that keep you motivated by keeping your goals to yourself, then start by staying silent. Then, if you fall off track, you can experiment with sharing your goals and adding an accountability system.

Your Move: Think about one financial goal for 2026. Now ask yourself: Is this an identity goal ('I'm becoming...') or an action goal ('I'm doing X by Y date')? If it's identity-based, either convert it to an action goal, or keep it to yourself until you've made real progress.

Point #3 — “It’s worked for me incredibly well…”

“I've done this before for fitness and it's worked for me incredibly well, so I was wondering if anyone would be interested in starting up an accountability partner system for budgeting or finance goals.

If there's interest, we can work out the details, but I would think we could pair people based on common goals (sticking with budget/savings goal/debt paydown goal/etc) and then provide your partner with monthly or bimonthly screenshots of your budget or YNAB [“You Need A Budget” app] screen showing your progress.

I know personally I would be much less likely to stop for fast food, buy a bottle of wine, or blow that frivolous cash that ends up having an effect on my budget if someone else will be looking at it or critiquing it, so I think there are probably others out there in the same boat.”

One thing I loved about this approach: they leveraged a strategy from a completely different area of life. Fitness accountability worked for them? Experiment applying those same principles to money.

Notice the key elements here:

Regular check-ins (monthly/bimonthly) - not just one announcement

Specific metrics (YNAB screenshots) - tangible progress, not subjective measures

Peer matching (same goals) - mutual accountability, not showing off

While many people might prefer enlisting an accountability partner they know and trust, the underlying principles and effectiveness still holds.

So, if you haven’t experimented with this type of system, I encourage you to give it a shot in the new year. Pick one financial goal. Text a trusted friend to get started.

Point #4 — How to Design S.M.A.R.T. Goals

One way to check that you’re not “just” creating identity goals, which may be vulnerable to lack of follow-through, is to use the S.M.A.R.T. framework:

Specific: Not "get better with money" but "save $500 toward emergency fund."

Measurable: Can you track it? Bank balance, debt paydown amount, number of freelance consulting pitches sent.

Achievable: Within your current capacity. Stretch goals are fine, but unrealistic goals can be demoralizing.

Relevant: Does this actually move you toward financial stability? Or gets lost in the details? Is it a random goal that sounds impressive?

Time-bound: "By March 31st" or "every Friday for 12 weeks." Deadlines create urgency.

Bottom Line: Identity goals ("I'm becoming debt-free") tend to fail multiple SMART criteria. Action goals ("Pay $300 extra toward credit card #1 monthly through June") nail all five.

Point #5 — Quotes of the Week

Continuing the “Goal Sharing” theme, which of these is your favorite?

“Have someone who expects something of you.”

Point #6 — My Questions of the Week

Consider some past goals you’ve accomplished, financial or otherwise. Which approach tends to work for you: keeping your goal silent or sharing it with an accountability partner?

Reply to let me know! I read every response.

Thanks for reading — I hope you found a helpful idea or two.

I’ll see you next Saturday with more.

Have a great weekend,

Benjamin Daniel, CFP®

Founder, Money Wisdom

P.S. Want to take control of your money, stop stressing about your expenses, & feel confident about your financial future? There are 2 ways I can help you:

Financial Health Check: Get your biggest money questions answered, understand where you stand financially, and get a personalized action plan from a CFP® professional. Book a free Intro Call here to see if you’re a good fit.

Financial Coaching: If you’d like some accountability in getting your finances into shape, engage in financial coaching. Build the habits & systems to help you start building wealth, pay off debt, and feel confident about achieving your goals. Reply to this email and say “Coaching” to join the waitlist.

Disclaimer:

This material is not investment or tax advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher.

How helpful was today's newsletter?

👉 Is there another topic(s) you would like me to cover? If so, reply to this email & let me know—I read & respond to ALL emails.