Read Time: 4-minutes

Happy Saturday,

Here is this week’s edition of 6-Point Saturday — financial insights to help you make smarter money decisions.

Table of Contents*

*Clickable in the online version.

Point #1 — Everything’s Fine…Until It Isn’t

A bit of a cautionary tale this week — drawn from Nassim Taleb’s New York Times bestseller, The Black Swan:

“Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say.

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief…”

“Consider that the turkey’s experience may have, rather than no value, a negative value. It learned from observation, as we are all advised to do (hey, after all, this is what is believed to be the scientific method).

Its confidence increased as the number of friendly feedings grew, and it felt increasingly safe even though the slaughter was more and more imminent. Consider that the feeling of safety reached its maximum when the risk was at the highest!

But the problem is even more general than that; it strikes at the nature of empirical knowledge itself. Something has worked in the past, until—well, it unexpectedly no longer does, and what we have learned from the past turns out to be at best irrelevant or false, at worst viciously misleading.”

You could replace the turkey’s feeders with any of the biggest companies like Amazon, Target, and UPS, laying off (or announcing plans to) tens of thousands of employees ($). (Some were even notified by a text message in the early-morning hours to avoid access badge mishaps at the office.)

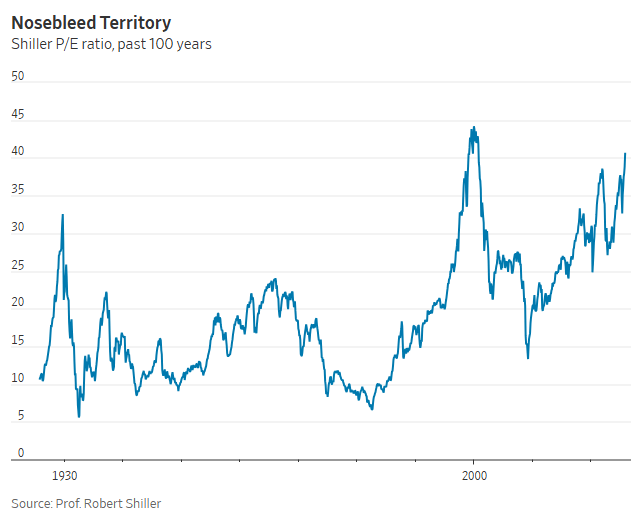

Or the stock market: The Shiller Price-to-Earnings ratio, which uses inflation-adjusted average returns to cover an entire business cycle, is now at levels not seen since the height of the dot-com bubble in 2000:

Or even the economy: The average economic expansion post-World War II has been about 6.5 years. We’re 5.5+ years since the start of the current expansion, beginning in April of 2020.

Everything’s fine…until it isn’t.

The key is to position yourself in a way to withstand these unexpected shocks.

Let’s look at 7 moves you can start making today so that nothing takes you by surprise.

Point #2 — 7 Moves Even When “Everything’s Fine”

The time to strengthen your finances is when everything feels relatively fine — that’s when you build a financial cushion, diversify risk, and stay sharp:

1. Strengthen Your Stability Fund

If you've been operating with a modest emergency fund (or worse, none at all), it's time to take it seriously. The standard advice is 3-6 months of fixed living expenses, but I’m not opposed to doubling it to 6-12 months.

2. Be Wary of Excess Financial Risk

The Wall Street Journal recently reported an increase in adjustable-rate mortgages as buyers chase affordability. You really need to understand what you’re getting into with these kinds of mortgages (more on this in Point #4). If interest rates increase, so does your mortgage payment — potentially straining the rest of your finances. So, don't let FOMO push you into excess risk-taking,

3. Address Concentration Risk

If a significant chunk of your net worth is tied up in your employer's stock (RSUs, ESPP, stock options), a company downturn can hit you twice: you could lose your income and your holdings can sink.

Set a rule: for example, never let company stock exceed 5-10% of your net worth. Sell and diversify systematically, even if it means paying taxes.

4. Make Yourself Indispensable at Work

If you've been “coasting” a bit at the office—doing good work but not growing—it's time to get more visible on critical projects. As former lead FBI hostage negotiator Chris Voss recommends, ask your manager something along the lines of: "How can I be involved in projects critical to the company’s future?"

5. Stay On Top of AI

AI may not be coming for your job, but someone using AI might be. So, find time to experiment and upgrade your AI skillset. Play with Agent workflows, advanced prompting, etc.

Helpful resource: Subscribe to something like the AI Daily Brief podcast (unaffiliated) to stay current without feeling overwhelmed.

6. Explore a Side Income

Having a secondary income stream creates optionality. It could be consulting, freelancing, teaching, or building a small digital product. Even $500-$2,000/month gives you breathing room and proves to yourself that you can generate income independently.

Helpful resources (unaffiliated): Justin Welsh (“solopreneurship”), Dickie Bush & Nicolas Cole (writing/digital products), & Katelyn Bourgoin (marketing).

7. Network Before You Need It

The time to strengthen your professional relationships is not when you need a job, but when you don't. Reach out to former colleagues. Catch up. Share helpful articles & make introductions. Offer value without asking for anything.

Helpful resource: Jordan Harbinger's Six-Minute Networking course (unaffiliated) teaches you how to make networking feel natural.

Action Step: Which of these strategies helps mitigate your biggest vulnerability?

Point #3 — “Is This Enough For My Emergency Fund?”

I am a 27(m). I currently rent an apartment with my girlfriend. We both have full time jobs. I am a FF [firefighter] with a pension plan with the FRS. Also have a 457b and Roth IRA account. Wanting to know what would be a good amount to have for my emergency fund? I see people say anywhere from 3-6 months worth of expenses. But I don't own a house for house repairs. Would $5k be sufficient? I know it varies on my expenses, however, just wanting to put more money towards other savings and what not.

A stable government job, pension, 457b plan, and Roth IRA. Everything sounds fine, so why worry about keeping “too much” cash sitting around when it could be investing and growing?

Let me show you why $5k probably isn’t enough, even for someone in this seemingly stable position (and without the need to worry about "home repairs”).

While we don’t have an exact fixed expenses figure here, we can make some reasonable & conservative estimates…

Let’s assume between rent, utilities, groceries, insurance, fixed expenses are at least $2k-$3k.

The minimum 3 month emergency fund, then, is $6k to $9k. So, $5k is still $1k to $4k short.

“But I’m a firefighter with a pension! I’m not getting laid off.”

Maybe, but here’s what can still happen:

Girlfriend loses her job and suddenly you’re pressured to cover full rent

ER trip/medical emergency costs

Unexpected car repairs

Family emergency requires travel & time off

Expensive trip(s) to the vet for a pet

And some of these are related, so they can happen all at once.

Your stability fund isn’t something to “cut it close” on. Build it up when life feels stable, so that you’re ready for when it isn’t.

Point #4 — Adjustable Rate Mortgages Explained

As mentioned in Point #2, Adjustable-Rate Mortgages (or ARMs) are one financing option available to home buyers. So, what are they exactly?

ARMs are set up with a fixed interest rate for an initial period of time before transitioning to an adjustable interest period. During this second phase, the interest rate on your mortgage can fluctuate based on an underlying benchmark rate.

What’s the tradeoff? ARMs initially offer lower fixed interest rates than traditional, fixed rate mortgages. But then you deal with the possibility of higher rates as you transition into the adjustable rate period. ARMs do have interest rate “caps,” which limit the amount your interest rate can increase at various points in the loan.

Bottom line: ARMs can make sense for certain home buyers. For example, those who plan to have the loan for only a short period of time or expect to be able to easily make payments throughout the life of the loan. But beware taking out an ARM when you’re only trying to make a home more affordable: the initial low-interest offers are probably not worth the risk on the backend.

Point #5 — Quotes of the Week

Continuing the “Everything’s fine, until it isn’t” theme, which of these is your favorite?

Point #6 — My Questions of the Week

How many months would your current emergency fund sustain you? Does that number make you feel secure?

Reply to let me know! I read every response.

Thanks for reading — I hope you found a helpful idea or two.

I’ll see you next Saturday with more.

Have a great weekend,

Benjamin Daniel, CFP®

Founder, Money Wisdom

P.S. Want to take control of your money, stop stressing about your expenses, & feel confident about your financial future? There are 2 ways I can help you:

Financial Health Check: Get your biggest money questions answered, understand where you stand financially, and get a personalized action plan from a CFP® professional. Book a free Intro Call here to see if you’re a good fit.

Financial Coaching: If you’d like some accountability in getting your finances into shape, engage in financial coaching. Build the habits & systems to help you start building wealth, pay off debt, and feel confident about achieving your goals. Reply to this email and say “Coaching” to join the waitlist.

Disclaimer:

This material is not investment or tax advice. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading this material can be accepted by the publisher.

How helpful was today's newsletter?

👉 Is there another topic(s) you would like me to cover? If so, reply to this email & let me know—I read & respond to ALL emails.